utah county sales tax calculator

Just enter the five-digit zip code of the. Sales tax in Utah County Utah is currently 675.

Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87.

. 274 rows Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. Some cities and local governments in Utah County collect additional. S Utah State Sales Tax Rate 595 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the Utah.

The Utah County sales tax rate is. Census Bureau American Community Survey 2006. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

This means you should be charging Utah customers the sales tax rate for where your business is located. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. The Utah state sales tax rate is currently.

Avalara provides supported pre-built integration. That rate could include a combination of. 2022 2021 2020 2019.

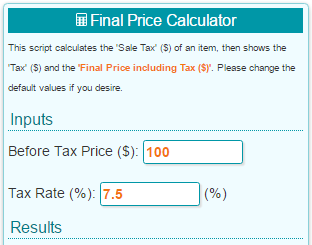

Sales Tax Chart For Salt Lake County Utah Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 749 in Salt Lake County Utah. Sales Tax Calculator Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what kind of sales. The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local sales tax consists of a 180 county sales tax and a.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Please use the options below to search for your tax rates by district or year. Calculators World Taxes Contact 2022 Utah Sales Tax By County Utah has 340 cities counties and special districts that collect a local sales tax in addition to the Utah state sales tax.

Find your Utah combined state and local tax rate. Tax rates are also available online at Utah Sales Use Tax Rates or you can. There are a total of 131 local tax jurisdictions across the state.

Utah is an origin-based sales tax state. The December 2020 total local sales tax rate was also. Utah sales tax rates vary depending on which.

The sales tax rate for Utah County was updated for the 2020 tax year this is the current sales tax rate we are using in the Utah County Utah. 91 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions. Utah UT Sales Tax Rates by City all Utah UT Sales Tax Rates by City all The state sales tax rate in Utah is 4850.

Avalara provides supported pre-built integration. CO County Option Sales Tax MT Mass Transit Tax MA Addl Mass Transit Tax MF Mass tran Fixed Guideway CT County Option Transportation HT Highways Tax HH County. Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what kind.

Sales Tax Calculator Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what kind of sales. With local taxes the total sales tax rate is between. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010.

The 2018 United States Supreme Court decision in South Dakota v. Has impacted many state nexus. Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what kind.

S Utah State Sales Tax Rate 595 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate So whilst the Sales Tax Rate in Utah. Search by District. Sales Tax Rate s c l sr Where.

A county-wide sales tax rate of 08 is applicable to localities in Utah County in addition to the 485 Utah sales tax. Utah County UT Sales Tax Rate Utah County UT Sales Tax Rate The current total local sales tax rate in Utah County UT is 7150.

How To Charge Your Customers The Correct Sales Tax Rates

How To Calculate Sales Tax On Almost Anything You Buy

Sales Tax By State Is Saas Taxable Taxjar

Utah Sales Tax Small Business Guide Truic

Lottery Tax Calculator Updated 2022 Lottery N Go

Item Price 35 Tax Rate 6 Sales Tax Calculator

Sales Taxes In The United States Wikiwand

State Corporate Income Tax Rates And Brackets Tax Foundation

States With Highest And Lowest Sales Tax Rates

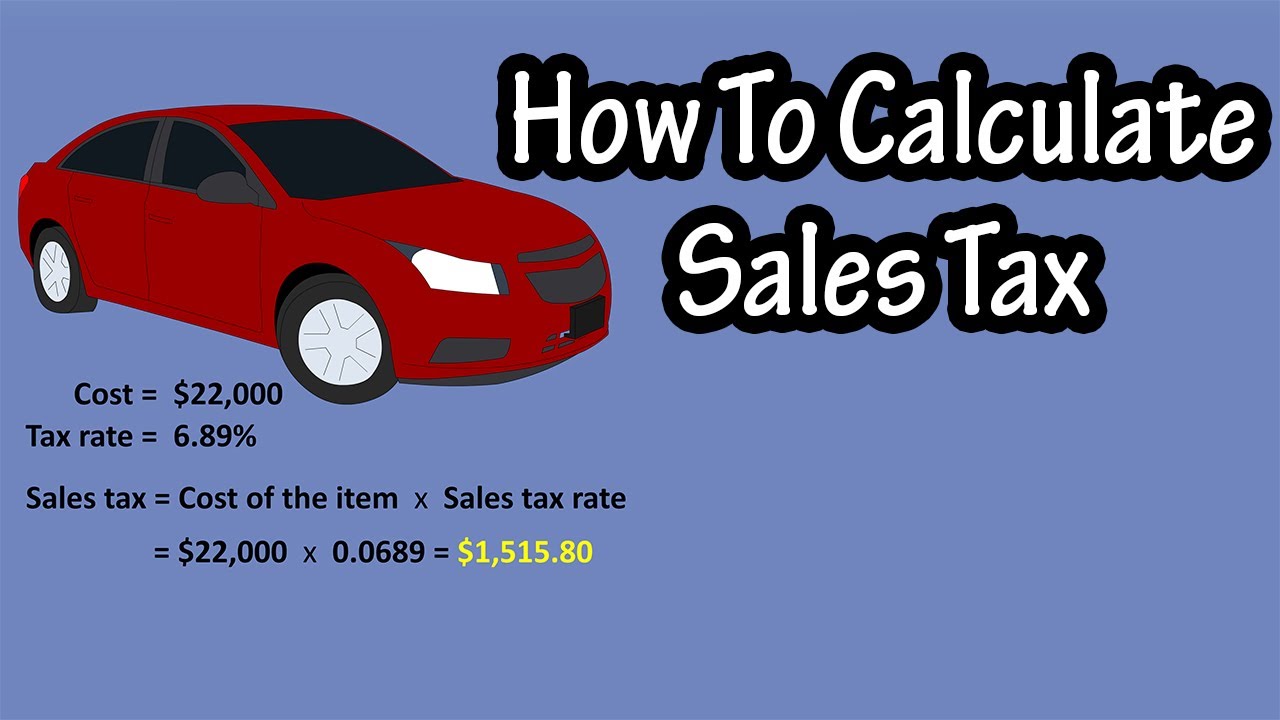

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

State Income Tax Rates Highest Lowest 2021 Changes

Utah Income Tax Calculator Smartasset

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)